Every SaaS company that survives long enough will face a brand architecture crisis. It usually starts innocently: you ship a second product, acquire a complementary tool, or launch an enterprise tier with its own positioning. Suddenly, the clean single-product brand you built in the early days is straining under the weight of multiple offerings, overlapping audiences, and naming conventions that made sense to the engineering team but confuse everyone else.

SaaS brand architecture is the strategic framework that determines how your company, products, features, and tiers relate to each other in the minds of your customers. Get it right, and every new product launch strengthens your market position. Get it wrong, and you create a portfolio of confusion that slows sales cycles, inflates marketing costs, and erodes the trust you spent years building.

This guide walks through the unique brand architecture challenges facing SaaS companies, the proven models available, and the specific decisions you need to make at each growth stage.

Why SaaS Companies Face Unique Brand Architecture Challenges

Traditional brand architecture frameworks were built for consumer packaged goods companies managing portfolios of physical products. SaaS companies operate in a fundamentally different environment, and that environment creates brand architecture problems that legacy frameworks struggle to address.

Rapid Product Iteration

Software products evolve continuously. Features become products. Products become platforms. A capability that was a bullet point on your pricing page in January might warrant its own landing page, sales motion, and positioning by June. This pace of change means your brand architecture must be flexible enough to accommodate constant evolution without requiring a full rebrand every quarter.

Blurred Feature-to-Product Boundaries

When does a feature become a product? In SaaS, this boundary is perpetually fuzzy. Your analytics dashboard might start as a feature of your core platform, grow into a standalone module, and eventually become a separately-sold product. Each transition creates brand architecture decisions that ripple across your marketing, sales, and product organizations.

Freemium and Tiered Pricing Complexity

Most SaaS companies operate with multiple pricing tiers, each serving different customer segments with different needs. When your free tier, pro tier, and enterprise tier serve fundamentally different audiences, you are effectively managing multiple brands under one roof, whether you acknowledge it architecturally or not.

Acquisition-Driven Growth

SaaS growth frequently involves acquiring complementary products. Each acquisition brings its own brand equity, customer base, and market positioning. The decision of whether to absorb, endorse, or maintain an acquired brand is one of the most consequential architecture choices a scaling SaaS company makes.

Developer and API Ecosystems

Many SaaS companies serve both end-users and developers. These audiences have radically different expectations, communication styles, and trust signals. Your brand architecture must accommodate both without diluting either experience.

The Three Core SaaS Brand Architecture Models

While the specifics vary, nearly every SaaS brand architecture decision maps to one of three foundational models. Understanding each model and its tradeoffs is essential before making architecture decisions for your own company.

Model 1: Branded House

In a Branded House model, the master brand is the star. Every product, feature, and tier operates under the parent brand name with descriptive modifiers. Think of how Google structures its portfolio: Google Docs, Google Sheets, Google Drive, Google Cloud. The parent brand carries the weight, and individual products inherit its equity.

Best for: Companies with strong brand recognition where the parent brand adds credibility to every new product. Works well when products serve overlapping audiences and cross-selling is a primary growth lever.

- Advantages: Maximum brand equity transfer to new products, lower marketing costs for launches, unified customer experience, simplified sales conversations

- Risks: A failure in one product can damage the entire portfolio. Limits your ability to serve radically different market segments. Can feel monolithic as the portfolio grows.

Model 2: House of Brands

In a House of Brands model, each product operates as an independent brand with its own identity, positioning, and audience. The parent company may or may not be visible to end customers. This is how companies like IAC or Constellation Software manage their SaaS portfolios, with dozens of independently-branded products under one corporate umbrella.

Best for: Companies with products serving fundamentally different markets, or where acquired brands carry significant independent equity. Also suits companies where product failures in one area should not contaminate others.

- Advantages: Maximum flexibility for positioning each product independently, insulates brands from each other's failures, allows aggressive M&A without forced integration

- Risks: No brand equity transfer between products, higher marketing costs, missed cross-selling opportunities, complex brand governance

Model 3: Endorsed Brands

The Endorsed Brands model is the hybrid approach, and arguably the most common among scaling SaaS companies. Each product has its own distinct brand identity but is visibly endorsed by the parent company. You see this pattern in companies like Atlassian (Jira by Atlassian, Confluence by Atlassian) or Adobe (Adobe Photoshop, Adobe Premiere).

Best for: Companies that want the flexibility of independent product brands while still leveraging parent brand trust. Particularly effective when products serve adjacent but not identical audiences.

- Advantages: Balances brand equity transfer with product independence, allows differentiated positioning while maintaining trust, accommodates acquisitions more naturally

- Risks: Requires careful governance to maintain consistency, the endorsement relationship can feel forced if products are too dissimilar, more complex to execute than either pure model

When to Stretch Your Brand vs. Create a New Sub-Brand

This is the single most common brand architecture question SaaS leaders face: should we put our existing brand on this new offering, or does it need its own identity? The answer depends on four factors.

Factor 1: Audience Overlap

If the new product serves the same buyers who already use your existing products, stretching your brand is almost always the right call. Your existing brand equity reduces the trust gap and shortens sales cycles. If the new product targets a fundamentally different buyer persona, a sub-brand or independent brand gives you more positioning flexibility.

Factor 2: Value Proposition Alignment

Does the new product reinforce or contradict what your brand currently stands for? If your brand is known for simplicity and you are launching an enterprise-grade configuration tool, stretching the brand may create cognitive dissonance. The further the new product strays from your brand's core promise, the stronger the case for a separate identity.

Factor 3: Risk Tolerance

New products carry inherent risk. If the new offering is experimental or targets an unproven market, a sub-brand creates a firewall that protects your core brand from potential failure. If you are confident in the product's viability and its alignment with your brand, stretching is more efficient.

Factor 4: Go-to-Market Efficiency

Every new brand you create requires its own marketing investment: positioning, messaging, content, advertising, and sales enablement. If you are resource-constrained, stretching your existing brand dramatically reduces go-to-market costs. If you have the budget and the strategic rationale, a new brand can open markets that your existing brand simply cannot reach.

The Decision Framework

| Factor | Stretch Existing Brand | Create Sub-Brand |

|---|---|---|

| Audience overlap | High (same buyers) | Low (new buyer persona) |

| Value proposition | Reinforces core promise | Contradicts or diverges |

| Risk level | Low (proven market) | High (experimental) |

| Resources available | Limited budget | Sufficient for new brand investment |

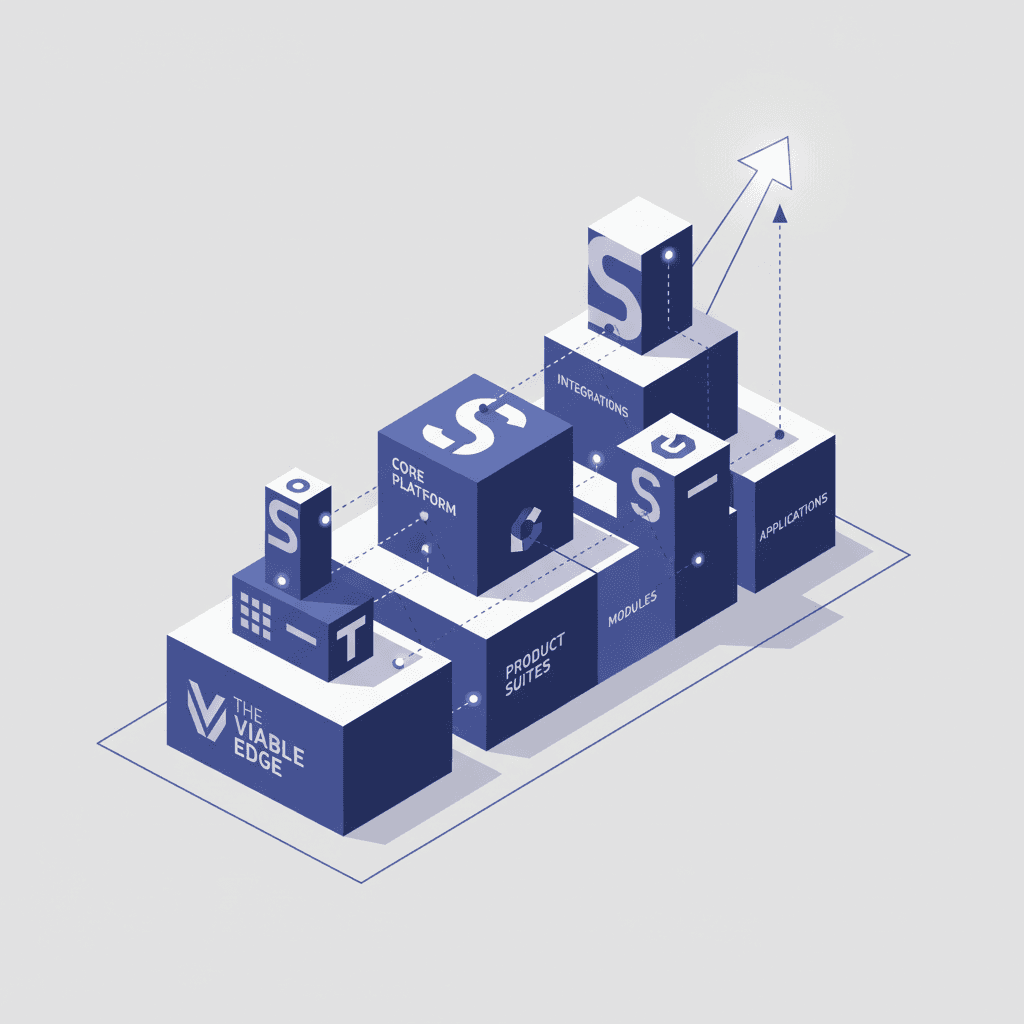

The Product-to-Platform Evolution

One of the most significant brand architecture transitions in SaaS is the evolution from individual tool to integrated suite to full platform. Each stage demands different architectural thinking.

Stage 1: Single Product

At this stage, brand architecture is straightforward. Your company name and your product name are often the same thing. The brand promise is tightly coupled to a single value proposition. Enjoy this simplicity while it lasts.

Stage 2: Product Suite

As you add products, you transition into suite territory. This is where naming strategy becomes critical. Each product needs a name that is distinct enough to stand on its own but connected enough to signal that it is part of a cohesive offering. The most common pattern is [Company Name] + [Product Descriptor]: HubSpot Marketing Hub, HubSpot Sales Hub, HubSpot Service Hub.

Stage 3: Platform

The platform stage represents a fundamental brand architecture shift. Your brand is no longer about the products themselves but about the ecosystem they create together. The platform brand sits above individual products and embodies a higher-order value proposition: not "we make great tools" but "we provide the infrastructure for your entire workflow." Salesforce executed this transition masterfully, evolving from a CRM product to the Salesforce Platform that underpins an entire ecosystem.

Each transition requires deliberate brand architecture planning. Companies that drift into these transitions without strategic intent end up with confusing portfolios that neither customers nor sales teams can navigate clearly.

Naming Strategy for Features, Products, and Tiers

Naming is where SaaS brand architecture becomes tangible for customers. A clear naming convention signals organizational clarity. A chaotic one signals the opposite.

Feature Naming

Features should use descriptive, functional names that help users understand what they do without requiring explanation. Resist the temptation to brand every feature. When everything has a proper noun, nothing stands out, and your product becomes harder to learn and navigate. Save branded names for capabilities that are genuinely differentiated and central to your value proposition.

Product Naming

Product names need to balance distinctiveness with discoverability. The name should hint at the product's function while being memorable enough to stick. Avoid names that are too abstract (customers will not remember them) or too generic (they will not differentiate you). Test names with real customers before committing.

Tier Naming

Pricing tier names should communicate relative value without implying that lower tiers are inadequate. The most effective tier naming conventions use progression language that makes each step feel like an upgrade rather than making the lower tiers feel like punishment. Avoid creative tier names that require explanation. "Starter, Professional, Enterprise" is clear. "Spark, Blaze, Inferno" is not.

Naming Governance Rules

- Establish a naming committee that includes product, marketing, and sales leadership

- Document naming conventions and enforce them across teams

- Audit your naming landscape quarterly to catch drift

- Test all names with customers before public launch

- Maintain a glossary that maps internal names to customer-facing names

Architecture Decisions at Each Growth Stage

SaaS brand architecture is not a one-time decision. It evolves as your company grows. Here is what to focus on at each stage.

Seed and Early Stage: Keep It Simple

At this stage, your company is your product. Do not over-engineer your brand architecture. Use your company name as your product name. Focus on building brand equity around a single, clear value proposition. The only architecture decision that matters right now is ensuring your brand name and positioning have room to expand when the time comes. Avoid names that are too narrow or too tied to a specific feature.

Series A/B: First Architecture Decisions

This is typically when the first real brand architecture questions emerge. You are adding features that feel like products. You might be launching a second product or considering your first acquisition. At this stage, make two critical decisions:

- Naming convention: Establish how you will name products going forward. This is much easier to get right now than to fix later.

- Tier strategy: Define how your pricing tiers relate to your brand. Are tiers purely about feature access, or do they represent different brand experiences?

Series C and Growth Stage: Portfolio Management

At this stage, you likely have multiple products, several tiers, and possibly an acquisition or two. Brand architecture becomes a portfolio management discipline. Key activities include:

- Formalizing your brand architecture model (Branded House, Endorsed, or House of Brands)

- Creating brand architecture guidelines that product and marketing teams follow

- Establishing an integration playbook for M&A brand decisions

- Building a brand hierarchy that customers can intuitively navigate

- Aligning sales enablement materials with your architecture

Post-IPO: Brand Governance at Scale

Public companies face heightened scrutiny of their brand portfolio. Investor communications, analyst relations, and regulatory requirements all intersect with brand architecture. At this stage, establish:

- A formal brand governance board with executive sponsorship

- Brand architecture review as part of the M&A due diligence process

- Quarterly brand portfolio audits measuring equity, overlap, and efficiency

- Clear escalation paths for architecture decisions that impact multiple business units

The M&A Brand Integration Playbook for SaaS

Acquisitions are where SaaS brand architecture decisions carry the highest stakes and the tightest timelines. A disciplined integration playbook prevents the ad-hoc decisions that turn a promising acquisition into a brand architecture disaster.

Pre-Acquisition Assessment

Before closing the deal, evaluate the acquired brand across four dimensions: brand equity strength, audience overlap with your existing portfolio, technical integration complexity, and cultural alignment. This assessment determines your integration strategy from day one.

The Four Integration Strategies

- Full Absorption: The acquired product is rebranded entirely under your parent brand. Best when the acquired product fills a feature gap and has limited independent brand equity.

- Endorsed Integration: The acquired product retains its name but gains your company's endorsement. Best when the acquired brand has meaningful equity that would be destroyed by full absorption.

- Portfolio Addition: The acquired brand operates independently within your portfolio. Best when the acquisition serves a fundamentally different market or when the brand equity is the primary asset you acquired.

- Gradual Migration: A phased approach that starts with endorsement and moves toward absorption over 12 to 24 months. Best when you need to retain existing customers while building awareness of the combined offering.

Integration Timeline

Regardless of which strategy you choose, the first 90 days after acquisition close are critical. Communicate your brand architecture decision to both customer bases immediately. Ambiguity during this window creates confusion that takes months to resolve. Even if the full integration will take a year, customers should understand the relationship between your brands from day one.

Common SaaS Branding Mistakes

After analyzing brand architecture across hundreds of SaaS companies at various stages of growth, these are the mistakes that appear most frequently and cause the most damage.

Over-Branding Features

When every feature gets its own branded name, logo treatment, and landing page, you create an alphabet soup that overwhelms customers and dilutes your core brand. Features should be descriptively named unless they represent genuinely differentiated intellectual property. The test: if a feature would not make sense as a standalone product, it does not need a branded name.

Confusing Tiers with Products

Your pricing tiers are not separate products, and they should not be branded as such. When "Pro" and "Enterprise" start feeling like different brands with different value propositions, you have created unnecessary complexity. Tiers should represent levels of access to the same core product experience, not fundamentally different offerings.

Inconsistent Naming Conventions

Nothing signals organizational disarray faster than inconsistent naming. If some products use [Company + Descriptor], others use standalone names, and others use acquired brand names, customers cannot build a mental model of your portfolio. Pick a convention and enforce it ruthlessly.

Ignoring Architecture Until It Is a Crisis

Most SaaS companies think about brand architecture only when the confusion becomes unbearable, typically when sales teams start complaining that prospects cannot understand the portfolio. By that point, remediation is expensive and disruptive. Proactive architecture planning at each growth stage prevents these crises.

Copying Consumer Brand Playbooks

SaaS brand architecture has different dynamics than consumer goods. Subscription relationships, usage-based pricing, API ecosystems, and developer audiences all create dynamics that Procter and Gamble never had to navigate. Use SaaS-specific frameworks rather than blindly adopting consumer brand architecture models.

Framework: Evaluating Your Current SaaS Brand Architecture

Use this diagnostic framework to assess the health of your current brand architecture. Score each dimension on a scale of 1 (poor) to 5 (excellent).

Dimension 1: Customer Clarity

Can a new prospect understand your full product portfolio within 60 seconds of visiting your website? Can existing customers explain the relationship between your products to a colleague? If the answer to either question is no, your architecture has a clarity problem.

Dimension 2: Sales Efficiency

Do your sales teams spend significant time explaining what your products are and how they relate, rather than selling the value they deliver? High-performing brand architectures make the sales conversation easier, not harder.

Dimension 3: Marketing Efficiency

Does every new product launch require building awareness from scratch, or does your parent brand provide a foundation of trust that accelerates adoption? Calculate the marketing cost per launch and track whether it is increasing or decreasing as your portfolio grows.

Dimension 4: Cross-Sell Performance

Are customers naturally discovering and adopting additional products in your portfolio? Poor brand architecture creates silos where customers of one product do not even know your other products exist. Strong architecture creates natural pathways between offerings.

Dimension 5: Architecture Scalability

If you launched two more products tomorrow, would your current naming convention and brand hierarchy accommodate them cleanly? If the answer is no, your architecture needs restructuring before further expansion.

Scoring Your Architecture

| Total Score | Architecture Health | Recommended Action |

|---|---|---|

| 20-25 | Strong | Maintain and refine. Conduct annual audits. |

| 14-19 | Moderate | Address specific weak dimensions. Formalize governance. |

| 8-13 | Needs Work | Comprehensive architecture review. May need restructuring. |

| 5-7 | Critical | Immediate intervention required. Architecture is actively harming growth. |

Building a SaaS Brand Architecture That Scales

SaaS brand architecture is not a marketing exercise. It is a strategic infrastructure decision that affects every function in your company: how product teams name and position new features, how sales teams navigate conversations across a growing portfolio, how marketing teams allocate budgets and build campaigns, and how customers perceive the coherence of your offering.

The companies that treat brand architecture as an ongoing discipline rather than a one-time project consistently outperform those that let their portfolios grow organically. They make deliberate decisions about naming, hierarchy, and integration at each growth stage. They invest in governance before it becomes a crisis. And they build architectures that make every new product launch easier than the last.

Whether you are a seed-stage founder choosing your first product name or a growth-stage leader integrating your third acquisition, the principles remain the same: start with clarity, build for flexibility, and govern with discipline. Your brand architecture is the scaffolding that either supports or constrains every growth initiative you pursue. Build it with the same rigor you bring to your product architecture, and it will serve you well through every stage of scale.